Gifting can be a powerful tool in estate planning, particularly for high-net-worth individuals seeking to pass wealth on tax-efficiently. But understanding the rules around Inheritance Tax (IHT), especially the seven-year rule, is essential to avoid unintended liabilities. Here's what you need to know, based on guidance from Evelyn Partners and more.

Photo: Pexels/Maitree Rimthong

The Basics: When Are Gifts Tax-Free?

Not all financial gifts are equal in the eyes of HMRC. Some are immediately exempt from IHT, while others may become taxable depending on their size, structure, and timing.

According to HMRC, the following gifts are typically tax-free:

- Gifts between spouses or civil partners (provided both are UK-domiciled)

- Up to £3,000 per tax year (the annual exemption)

- Small gifts under £250 per person per tax year

- Regular gifts made from surplus income; these must be part of a consistent pattern and not affect your standard of living

Gifts that don’t qualify for these exemptions are classed as Potentially Exempt Transfers (PETs), and that’s where the seven-year rule becomes relevant.

The Seven-Year Rule: A Crucial Threshold

As Evelyn Partners explain, PETs are only fully exempt from IHT if the donor survives for seven years after the gift is made. If the donor dies within that period, the gift becomes “chargeable” and may reduce the available nil-rate band (currently £325,000 per person).

For example, if someone gives away £100,000 and dies within seven years, their nil-rate band is reduced to £225,000, increasing the IHT exposure on their estate.

Read more on this at GOV.UK

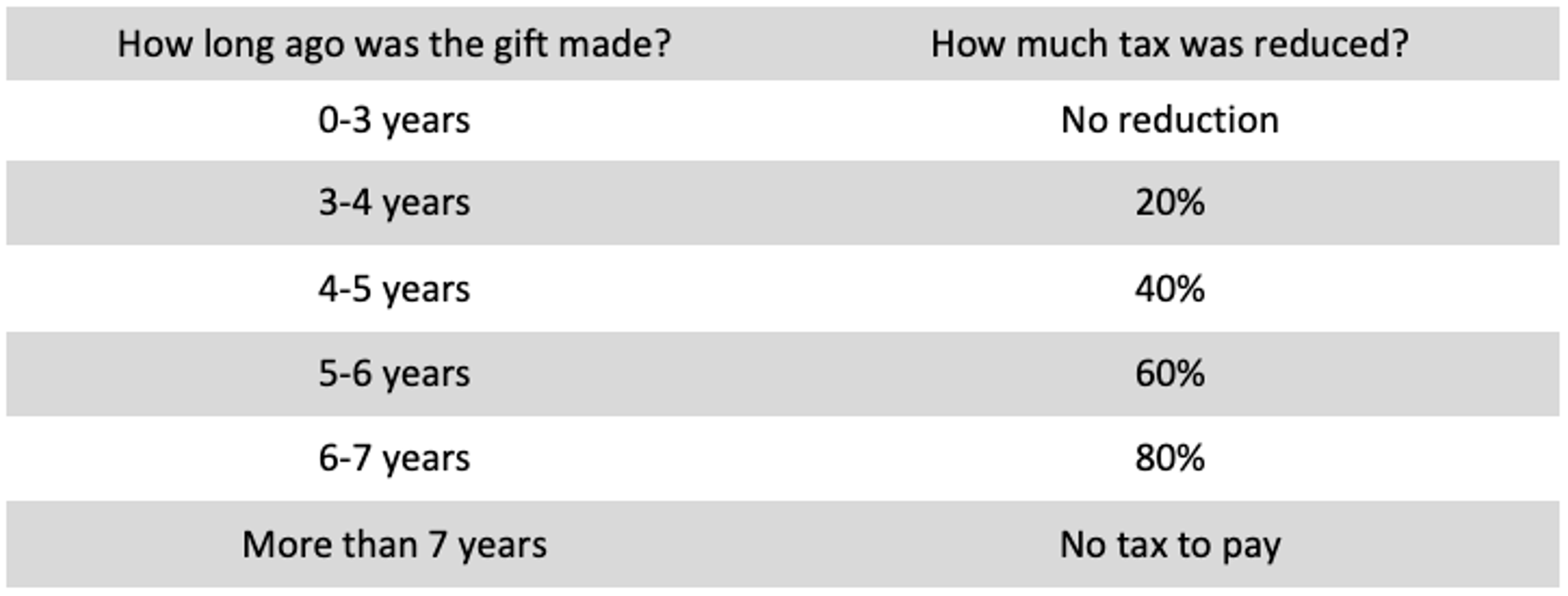

Taper Relief: Reducing the Tax Bill

If death occurs between three and seven years after a gift is made, taper relief can reduce the amount of tax payable on the gift, though not on the rest of the estate.

It’s important to note, as Evelyn highlights, that taper relief only applies to tax on the gift, not the overall estate.

More Complex Gifting: Trusts and the 14-Year Rule

If you're using trusts as part of your estate plan, things can get more complicated. Certain gifts into trusts may trigger immediate IHT charges. In some cases, the 14-year rule can apply, where earlier gifts affect how later ones are taxed, especially if multiple gifts were made in succession. Professional guidance is essential here to avoid overlapping liabilities.

Real-World Examples: How Gifting Impacts Tax Bills

Evelyn Partners provides illustrative case studies. For instance:

Mrs Smith gave her son £100,000 and died four years later. This reduced her nil-rate band and led to an IHT bill of £310,000 on her £1 million estate.

Mr Jones gave his daughter £500,000 and died six years later. His daughter benefited from taper relief, paying only £14,000 on the gift above the nil-rate band, but the entire estate remained fully taxable.

You can explore those full examples in Evelyn’s article here.

Recent Trends: A Surge in Lifetime Gifting

According to The Times, UK parents gave a record £9.6 billion to their children in 2024, much of it to help with property purchases, and often with the intention of minimising future IHT.

This growing trend reflects increased awareness of IHT thresholds and the benefits of acting early. More families are using exemptions like the annual allowance and the seven-year rule to pass on wealth during their lifetime, helping loved ones now while reducing the potential tax burden on their estate later.

Final Thought: Professional Advice is Key

The potential tax savings from thoughtful gifting are significant, but so are the risks if done improperly. A qualified wealth planner can help you:

- Determine how much you can afford to gift without impacting long-term security

- Ensure gifts are structured to make the most of exemptions and reliefs

- Document surplus income gifts appropriately

- Manage any exposure from trust-based giving

At Compare Wealth Managers, we connect clients with trusted firms like Evelyn Partners and others, all of whom offer deep estate planning expertise. If you're thinking about making financial gifts, professional advice is one of the best gifts you can give not only yourself, but your beneficiaries too.

If you’re looking to get the ball rolling in terms of finding expert financial advice, just click the orange “Start comparing” button now to get going, or check out our 5* reviews from Trustpilot.