Are you thinking about buying a second property, flipping houses, or investing through a company in 2025? This guide explores the financial and tax implications of property investment in today’s UK market, with explanations and stats to help you decide.

Photo: PEXELS/Jessica Bryant

A Shifting Landscape for UK Property Investors

The UK property market has long been viewed as a stable route to building wealth. But in 2025, would-be investors face a more complex environment: rising mortgage rates, reduced tax reliefs and stricter regulations for landlords.

Whether you're considering a second home, a buy-to-let through a company or flipping for profit, it's time to ask: Is property still worth it?

Buying a Second Property: Still a Smart Move?

Purchasing a second property, often for rental income or long-term appreciation, can offer financial upside, but the barriers to entry have increased.

Pros:

- Monthly rental income (UK average rent: £1,339 per month as of May 2025 via HomeLet)

- Long-term capital appreciation, especially in high-demand areas

- Tangible, controllable asset

Cons:

- Stamp Duty Land Tax (SDLT) surcharge of 3% on additional properties (via HMRC)

- Higher interest rates for second property mortgages (typical rates 5.5-6.5%)

- Ongoing costs: insurance, letting agent fees, maintenance, and void periods

Verdict: It is worth considering in growth areas or for retirement planning, but only with strong rental yield and a clear exit strategy.

Flipping Property in 2025: Profitable or Pipedream?

Property flipping, buying, renovating and selling for profit, can generate quick returns, but it comes with risk.

What You Need to Know:

- Capital Gains Tax (CGT) of up to 24% on profit for higher-rate taxpayers (HMRC, 2024 Budget)

- Rising material and labour costs post-Brexit and during ongoing inflation (BCIS reports 2025)

- Local councils are tightening planning permission timelines

Example:

If you buy a home for £250,000, spend £50,000 on refurbishment, and sell for £350,000, your taxable gain is £50,000. As a higher-rate taxpayer, CGT could be as much as £12,000.

Verdict: Still viable for experienced investors, but tight margins mean due diligence and accurate cost forecasting are essential.

Should You Use a Limited Company to Invest in Property?

There’s been a surge in landlords using limited companies to hold property, over 320,000 buy-to-let properties are now owned via corporate structures, via Property Investor.

Why Investors Do It:

- Mortgage interest is fully tax-deductible for companies (unlike personal ownership, where relief is limited)

- Corporation tax capped at 25% vs. personal income tax of up to 45%

- Ability to retain profits within the business for reinvestment

Drawbacks:

- Higher mortgage rates for company borrowers (typically 0.5-1% more)

- Annual reporting obligations and accounting costs

- Personal use of property becomes restricted

Best for: Investors building a portfolio or higher-rate taxpayers looking to reduce tax exposure over the long term.

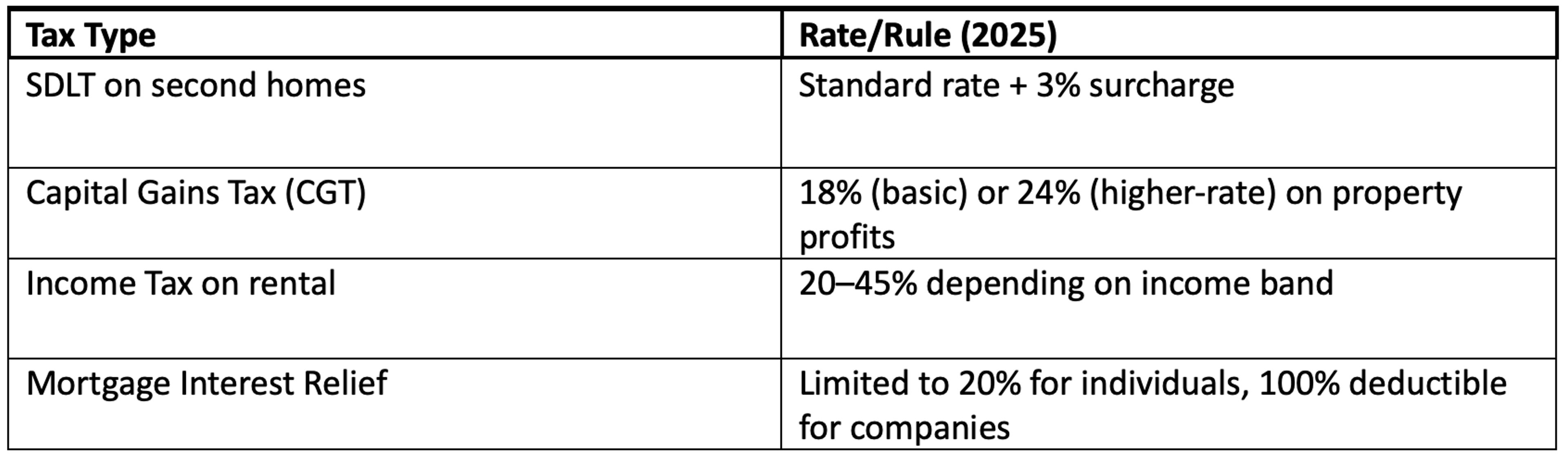

Understanding the 2025 Tax Landscape for Property Investors

Taxes have become a major deciding factor in property investment, so staying on top of them is vital for successful investors.

Key Tax Points:

(Source: HMRC, Budget 2024 Summary - GOV.UK)

Make sure you always factor in tax when assessing potential returns, particularly on short-term holds and second homes.

Is Property Still a Good Investment Compared to Other Assets?

UK residential property values grew 3.5% in the year to May 2025, with London and the South East seeing the strongest performance (Nationwide House Price Index, via FT). Rental yields remain solid, averaging 5.2% across the UK, and up to 7% in parts of the Midlands and North West, according to BaronCabot.

Things to keep in mind:

- UK equities returned 9.4% over the past 12 months (FTSE All-Share)

- Private credit and infrastructure funds are offering stable 6-9% yields with less hassle

- REITs offer hands-off property exposure with liquidity

Verdict: Property remains a good diversifier, but it’s no longer the only viable route for capital preservation or income generation.

Is Investing in Property Worth It in 2025?

Yes, for the right investor. Property can still deliver long-term wealth, but it's become a more hands-on, tax-sensitive, and financially demanding asset class.

If you’re planning to:

- Buy and hold for decades

- Build a rental portfolio

- Optimise via a company structure

…then it may be a smart move.

But if you’re looking for passive income, minimal tax hassle, and flexibility? Consider REITs, diversified funds, or alternative investments.

Frequently Asked Questions (FAQs)

Is property still a good investment in the UK?

Yes, especially for long-term investors seeking income and capital growth, but returns vary by location, structure, and tax efficiency.

Should I set up a company to buy property?

Possibly, if you’re a higher-rate taxpayer or plan to build a portfolio. Companies offer tax advantages but come with admin overheads.

Can I avoid the second home stamp duty surcharge?

Only if you’re replacing your main residence and complete the sale of your existing home within 36 months.

Looking to explore tax-efficient property investment or compare alternatives? Compare Wealth Managers connects you with FCA-regulated advisers who can help tailor strategies to your goals. Simply click the orange “Start comparing” button to explore your options now.